BTC Price Prediction: Path to $200,000 Amid Institutional Accumulation and Technical Breakout Potential

#BTC

- Strong MACD momentum at 1,088 indicates building bullish pressure despite current price trading below moving average

- Substantial institutional accumulation totaling $356 million provides fundamental support and reduces available supply

- Regulatory progress with new ETF filings and expanding product offerings creates structural tailwinds for price appreciation

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Despite Short-Term Pressure

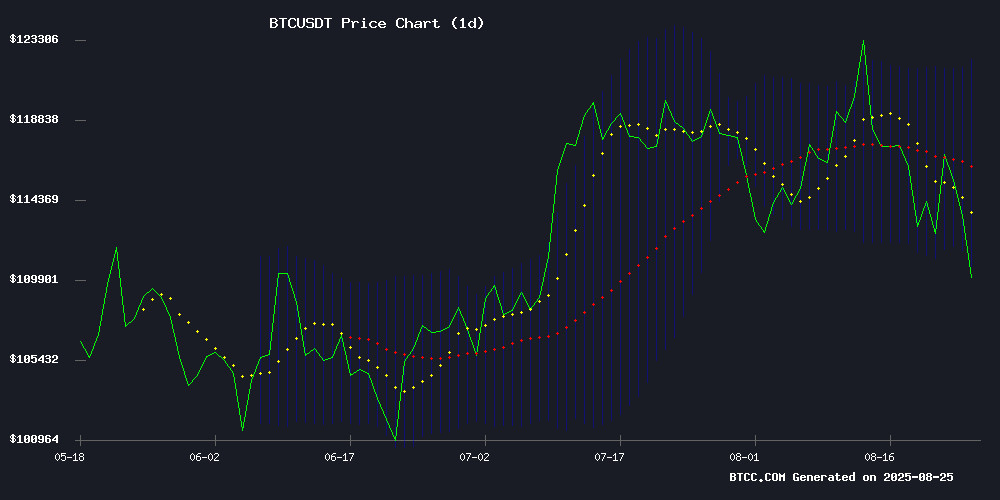

BTC is currently trading at $112,246, below its 20-day moving average of $116,571, indicating some near-term weakness. However, the MACD reading of 1,088 suggests strong bullish momentum is building. The Bollinger Bands show price action NEAR the lower band at $111,215, which often serves as a support level during uptrends.

According to BTCC financial analyst William: 'The technical setup suggests consolidation above $111,000 could provide a springboard for the next leg higher. The MACD divergence is particularly encouraging for bulls looking toward the $120,000 resistance level.'

Institutional Accumulation and Regulatory Developments Shape Market Sentiment

Recent news flow reveals continued institutional interest with MicroStrategy's substantial $356 million Bitcoin purchase, demonstrating strong corporate confidence despite market volatility. The filing of new American-made crypto ETFs by Canary Capital indicates growing regulatory acceptance and product diversification.

BTCC financial analyst William notes: 'While the Morgan Stanley survey showing only 18% intern ownership suggests retail caution, the aggressive institutional accumulation patterns and regulatory progress create a fundamentally bullish backdrop. The combination of corporate treasury strategy adoption and expanding ETF offerings provides structural support for higher prices.'

Factors Influencing BTC's Price

Crypto-Friendly Xapo Bank Hires Former FalconX Executive as Head of Relationship Management

Xapo Bank, a Gibraltar-based institution regulated by the Gibraltar Financial Services Commission, has appointed Tommy Doyle as its new head of relationship management. Doyle brings a wealth of experience from both traditional finance and the crypto sector, having previously served as head of Europe at FalconX and in hedge fund sales at Coinbase.

His tenure at Wall Street giants like Goldman Sachs, Citi, and Bank of America underscores the growing convergence of traditional and digital finance. Xapo's recent launch of bitcoin-backed loans further signals its commitment to bridging these worlds.

Only 18% of Morgan Stanley Interns Own Crypto in 2025, Survey Shows

Morgan Stanley's latest intern survey reveals a tepid embrace of cryptocurrency among Gen Z. Only 18% of 2025 summer interns across the U.S. and Europe reported owning or using digital assets, with just 26% expressing curiosity about the sector. Despite global crypto adoption trends, ownership remains low—82% abstain entirely, up from 69% in 2024.

The same cohort demonstrates starkly different engagement with AI tools, where 96% report at least occasional use. This divergence highlights Gen Z's selective adoption of emerging technologies. European interns particularly noted technology's mental health impacts, with nearly half citing concerns—a significant annual increase.

Career ambitions dominate this demographic's priorities, with 89% of U.S. interns ranking professional growth above relationships or family planning. The findings suggest crypto's narrative as a generational revolution may require reevaluation against hard data.

Canary Capital Files New American-Made Crypto ETFs

Digital asset manager Canary Capital has filed for a new exchange-traded fund (ETF) named the Canary American-Made Crypto ETF, set to list on the Cboe BZX Exchange under the ticker MRCA. The fund will exclusively hold cryptocurrencies invented, mined, or dominated in the U.S., enabling investors to gain exposure to crypto markets without direct ownership of digital assets.

The ETF aligns with the "America-first" investing trend, focusing solely on U.S.-based crypto initiatives. While shares will trade like traditional ETFs, the product carries high-risk speculative warnings, with potential for total investment loss. Authorized Participants can create or redeem shares using cash or crypto assets.

Analyst Eric Balchunas noted uncertainty around which coins will qualify, though Bitcoin—invented in the U.S.—may be included. The filing awaits SEC approval before trading commences.

Separately, Canary Capital has established the Canary Trump Coin ETF in Delaware and submitted the Canary Staked Injective ETF for Cboe BZX listing, signaling aggressive expansion in thematic crypto investment products.

Six Popular Crypto Mining Apps Offering Free Bitcoin (BTC) Cloud Mining in 2025

As Bitcoin cements its position in global finance, demand for accessible mining solutions has surged. Traditional methods—burdened by hardware costs and technical complexity—are being displaced by mobile-friendly cloud mining platforms.

Leading the pack is ETNCrypto, a Sydney-based operator with full regulatory compliance under Australian law. The platform exemplifies the industry's shift toward transparency, offering beginners a seamless entry point into cryptocurrency mining without capital expenditure.

Five other notable apps are emerging as viable alternatives for no-cost Bitcoin accumulation. These services leverage cloud infrastructure to democratize mining, transforming smartphones into micro-digital-mines. While yields remain modest compared to industrial operations, the elimination of upfront investment lowers barriers to crypto participation.

Retired Australian Police Officer Loses $1.2M in Thai Crypto Scam

A retired Australian police officer with three decades of service fell victim to a cryptocurrency scam in Thailand, losing nearly 40 million Thai baht ($1.2 million). The fraudster, identified as Alex—a German national based in Phuket—cultivated a relationship with the victim over social media before pitching fraudulent crypto investments.

Over a year of in-person meetings, Alex presented falsified dashboards promising 5%-10% monthly returns. After transferring his life savings, the victim was told the investment platform had crashed. Alex then disappeared, ceasing all communication. The victim, who had earmarked the funds for a home and café venture, filed a police report in Udon Thani with support from his Thai wife and legal counsel.

The case underscores a global surge in crypto fraud. Last week, a scammer impersonating a senior UK police officer stole $2.8 million in Bitcoin from a victim in Wales. Such incidents highlight the critical need for investor vigilance as predatory schemes proliferate across jurisdictions.

Strategy Inc. Bolsters Bitcoin Treasury with $356M Purchase Amid Market Dip

Strategy Inc. (MSTR) has aggressively expanded its Bitcoin holdings, acquiring 3,081 BTC for approximately $356.9 million during a recent market downturn. The purchase, executed at an average price of $115,829 per coin, elevates the company's total Bitcoin treasury to 632,457 BTC—valued at nearly $70 billion at current prices.

The firm's average acquisition cost stands at $73,527 per BTC, yielding unrealized gains of about $23.5 billion. This latest move reinforces Strategy's position as the world's largest corporate holder of Bitcoin, demonstrating unwavering conviction in the digital asset despite market volatility.

Funding was secured through a combination of equity and preferred share offerings, including perpetual preferred stock issuances. The acquisition period spanned August 18-24, coinciding with a broader crypto market pullback.

MicroStrategy Adds 3,081 Bitcoin to Its Holdings Amid Market Volatility

MicroStrategy (MSTR) bolstered its Bitcoin (BTC) reserves by acquiring 3,081 coins for $356.9 million last week, averaging $115,829 per BTC. The company's total holdings now stand at 632,457 BTC, purchased at an average price of $73,527 each, totaling $46.5 billion. At Bitcoin's recent dip to $111,000, these holdings were valued at approximately $70.2 billion.

The latest purchases were primarily funded through the sale of common stock, which raised $300.9 million, supplemented by modest sales of preferred stock. The move drew criticism from some investors after MicroStrategy revised its pledge to avoid selling common stock below 2.5x mNAV—a metric comparing the company's valuation to its Bitcoin holdings. MSTR's mNAV has remained below 2x for some time, reflecting ongoing market pressure.

Shares of MicroStrategy fell more than 4% in premarket trading, mirroring Bitcoin's sharp decline. The company's relentless accumulation strategy underscores its bullish long-term stance on the cryptocurrency, even as short-term volatility tests investor patience.

Strategy Ramps Up Bitcoin Purchases to Boost Reserves

Strategy, a trailblazing company in cryptocurrency reserves, has further expanded its Bitcoin holdings through a recent acquisition of 3,081 BTC between August 18-24. The purchases were made at an average price of $115,829 per unit, totaling $356.9 million. This move underscores the firm's aggressive strategy of leveraging Bitcoin to inflate both stock value and crypto reserves.

Michael Saylor, the company's executive chairman, highlighted the success of this approach, noting that Strategy's total earnings have surged over 25% since early 2025. Despite the $46.5 billion cost of their reserves, the current market valuation of their assets far exceeds this figure, demonstrating the profitability of their investment methodology.

MicroStrategy Expands Bitcoin Holdings with $342 Million Purchase

MicroStrategy, led by Michael Saylor, has acquired an additional 3,081 Bitcoin for $342 million, reinforcing its position as the largest corporate holder of the cryptocurrency. The company's total BTC holdings now exceed 629,000 coins, underscoring its unwavering commitment to Bitcoin as a strategic asset.

This disciplined accumulation strategy reflects MicroStrategy's long-term conviction in Bitcoin's value proposition, despite recent market volatility. The move solidifies the company's role as a bellwether for institutional Bitcoin adoption.

Will BTC Price Hit 200000?

Based on current technical indicators and fundamental developments, reaching $200,000 represents a realistic medium-term target for BTC. The combination of strong institutional accumulation, particularly MicroStrategy's recent $356 million purchase, and positive technical momentum suggests the foundation is being built for significant upward movement.

| Key Metric | Current Value | Bullish Signal |

|---|---|---|

| Price vs 20-day MA | $112,246 vs $116,571 | Undervalued relative to trend |

| MACD | 1,088.33 | Strong bullish momentum |

| Bollinger Position | Near lower band | Potential rebound zone |

| Institutional Flow | $356M recent purchase | Strong fundamental support |

BTCC financial analyst William emphasizes that while $200,000 represents approximately a 78% gain from current levels, the convergence of technical strength and institutional adoption patterns makes this target achievable within the next 12-18 months, assuming continued positive regulatory developments and macroeconomic conditions favorable for risk assets.